For the month of May, Advent Properties is proud to support our very own Leasing Agent, Tyler Powell. Tyler has been with the company now for over 3 years and is our sole Leasing Agent working directly with our owners to keep their properties occupied with our amazing tenants. Thanks to Tyler, Advent has an average of 28-40 days on Market for our properties. Which is less than the 30-60 average days you usually expect in the Bay Area. We sat down with Tyler and asked him questions on why he has so much success: more...

As retirement approaches, many people are concerned about ensuring their financial stability. One way to achieve this goal is by investing in real estate. Purchasing a rental home can provide a stable source of income during retirement, but there are several things to consider before making such a significant investment. more...

Nationwide, the challenges contractors are experiencing with fast-rising materials costs, uncertain delivery times, and rationing of vital inputs are due to the ongoing global construction struggles with materials shortages and prices. more...

It’s no secret that rent prices were dropping quickly during the pandemic – especially in major Bay Area cities. But according to a recent analysis, there are signs the pandemic-weary rental market is edging up just a bit. more...

Staging your home in the best way possible is proven to increase the value of your home. Walking into a house with basic furniture and decorations gives potential buyers an idea of what life will be like there. And removing personal items helps you disconnect from the home. more...

.jpg)

Photo by Sora Shimazaki from Pexels more...

Photo by August de Richelieu from Pexels.

It was one year ago that the World Health Organization declared COVID-19 a pandemic and changed the world. Here are some of COVID’s profound effects on the Real Estate and Mortgage Industries: more...

Photo by Andrea Piacquadio from Pexels more...

Gavin Newsom (CC BY-SA 4.0) by Gage Skidmore more...

Photo by Jorge Maya on Unsplash more...

Climate change continues to impact our community dramatically, with California’s annual fire season lasting longer and setting new records nearly every year. Wildfire smoke poses a number of public health concerns, especially for children, seniors, and individuals with underlying heart and lung illnesses. more...

As Bay Area residents do their part by turning their residences into virtual places of business and e-learning hubs, they must think about energy use. Whether using energy to power appliances and technology or light, heat or cool their homes, this increase in residential energy use could result in higher costs. more...

As a Property Owner, one of your most significant responsibilities is to keep up the property and repair things when they break. Although this can be high-priced and stressful if you budget and successfully plan for maintenance, you will have funds saved to handle these issues. Repairs tend to scare new landlords, but most maintenance issues are typically simple to repair. Even though you will rarely foresee when these issues happen, you can predict that they certainly will. more...

Buying a home is one of the most significant financial decisions you’ll make in your life. Although, on occasion, it can be one of the largest sources of stress for many first-time buyers is the financing process. Unless you’ve planned thoroughly and dedicated time for research, receiving a mortgage can feel complicated and overwhelming. Luckily, you could learn from these common mistakes first-time homebuyers make to have a less stressful experience: more...

While the spring market would usually be running at full power now, COVID-19 has put an impermanent stop to most real estate transactions. However, that does not imply that you cannot set aside the effort to prepare your home to be listed and available to be purchased once we flatten the curve. In light of that, here are four recommendations on things you can do to prepare your home to hit the market after stay-at-home orders have been relieved: more...

Cash vs. Mortgage Overview:

There's a lot to consider when contemplating purchasing a home outright versus financing it. Here are some of the major differences between using cash or a mortgage to buy a home: more...

Dear Friends & Fellow Citizens:

We are a group of individuals with resources and connections in Asia for Mask and PPE (Personal Protection Equipment) supplies. This campaign is to help fund the purchase of these vital supplies and deliver to those service providers in the most urgent need during this pandemic outbreak. We are ordering masks and PPE as we speak, and fundraising on the backend to help multiply our purchases by way of large quantity discounts. more...

As the coronavirus pandemic effects hit financial markets, U.S. bond yields are falling, driving mortgage rates that freely follow the 10-year Treasury yield toward an eight-year low. With no end in sight, they could sink even lower. The normal rate on a common 30-year fixed home loan hit 3.34% on Monday, as indicated by Mortgage News Daily. That is for borrowers with solid financials and FICO credit scores. more...

We've all had that one household item that was passed on or given away. But what about the items we know to be worth hanging on to for generations? Think staples that can stand the trial of time, nostalgic finds, or even flea market treasures you can't stand to leave behind. Today we'll be listing the stylistic layout pieces worth staying with, regardless of a remodel, a distant move or spring cleaning cleanse from a number of trusted home decor specialists. This is what you shouldn't leave behind at any point in the near future. more...

Selling your home can be both invigorating and upsetting, particularly if it's your first time. Despite why you chose to sell your home, there are various complexities you can accidentally fall into, making your home selling experience far less than perfect. Fortunately, we've assembled a summary of the most widely recognized home selling mistakes to avoid when selling your home.

Underestimating the cost of selling your house

While the point of selling your home is to eventually benefit from the profits, many home sellers disregard the expenses related to selling their home. First of all, you can hope to utilize five to six percent of the entire cost of your home to cover the commissions of both the seller and buyer agents. For instance, in the event that you sell your home for $700,000 you could end up paying upwards of $30,000 in commission fees. Besides, this substantial cost does exclude potential concessions homebuyers may need you to make during the negotiation stage, for example, making fixes proposed by a home inspector.

Skipping a pre-listing home inspection before selling your house

Selling a house can be stressful, even when everything is going according to plan. However, if a homebuyer employs an inspector who notices an issue like pests, mold, or a split foundation, your feelings of anxiety will increase as you jeopardize losing the entire deal. Given that home inspections are relatively affordable, there's very little motive to stay away from them. Getting a pre-posting home review will comfort your psyche, as you'll either realize that your house is in sound condition or you'll have the option to handle the issues before homebuyers get the opportunity to bring them up during the negotiation stage. In the event that an issue arises, you can either fix it or you can tell purchasers and afterward and make a concession during the negotiation stage by properly depreciating the cost of your home.

Pricing your home incorrectly

On the off chance that you price your home excessively high, your home may remain available on the market for an unfathomable length of time. Then again, in the event that you price your home very low, you'll probably sell your home swiftly yet you chance passing up a lot of cash. The initial step to seeing how much your house is worth is using an online calculator or contact Advent for a free home valuation consultation. Schedule a meeting with your realtor afterward to consider an adequate pricing method for your home. They will take a gander at similar properties in your neighborhood that were recently sold, as well as bring perceptive insights into what the housing market is currently doing. Together, you'll select a satisfactory opening cost as well as a pricing strategy that will incentivize purchasers if your home starts to sit available for a long time.

Not budgeting for your move

At the point when you think about the moving procedure, you have two choices: paying a moving company or get your friend's truck and moving your items with buddies. By hiring a moving company instead of moving without anyone's help, you're getting somebody who will pack, move, and afterward unload your things. This implies a full-service mover can certainly be justified despite the tasks associated with selling your home. Also, when you contract movers your assets are safeguarded so you're secured in the event that anything breaks.

Not addressing the exterior of your house

Throughout the years, your home's outside has gotten damaged from the elements. With everything the unstoppable force of life tosses at it consistently, the paint on your home's outside and the stain on your deck has likely lost a touch of their radiance. So before posting, make certain to pressure wash your home first. Ensuring your home puts its best self forward in the marketing photos, you will likewise improve the general check offer when purchasers, in the long run, arrive for a tour. Along with pressure washing your home and deck, you can likewise set aside the time to pressure wash your garage door entryway, fence, yard, driveways, and any walkways you may have.

One of the primary things a potential purchaser will see when they pull up to your house is the paint. On the off chance that you need to establish a suitable first impression, at that point you'll have to guarantee that your house is painted an intriguing color and that the nature of your paintwork is choice. While the activity of repainting your home may take a couple of days, the benefit of painting your home before selling will be certainly justified regardless of the effort. An ongoing report found that painting the outside of your home has a 51% quantifiable profit. But try not to stop with just the outside! In the event that you happen to have a bold and unfitting divider, you'll need to repaint them to be a more buyer-friendly neutral shade. Doing so will make it simpler for purchasers to have the option to imagine themselves living in your home as it makes them think about your dividers as a clear canvas. more...

Decorating the Perfect Guest Room

One of the many pleasures of home decorating is welcoming your friends, family, and loved ones into your home to experience it. If you're someone who loves to host (or even if you're not!), creating the ideal guest sanctuary is key to ensuring an unforgettable stay for your family and friends. more...

Home Trends can make your home feel and look new and refreshing, but they can also make your home feel outdated and uncomfortable. Some trends reach their end date while some become timeless. You might be asking yourself “How can I tell when my home needs to be renovated?” The most common method of staying up-to-date is to find blogs, influencers, and catalogs that fit the moods you want to show inside and outside of your home. You can modernize your home with small details like adding wallpaper, plants, and accents. Or you could go big and paint your rooms, order new furniture, or even add/remove the carpet.

But remember, trends change like the seasons. So here is a list of 10 Home Decor Trends we’ve noticed that are losing their appeal this forthcoming Winter Season.

1. Fake Plants

Implementing Plants in your home can help improve your indoor air quality. So place a few living plants in the appropriate hospitable locations of your home over several fake plants and flowers. If you’re concerned about your lack of a green thumb, here are a few suggestions that are easy to care for during winter.

• In an Overly-Heated Room: Cacti and Desert Plants

• In a Dry Room: Aloe or Fiddle Leaf Fig Trees

• In a Dry Room: Philodendrons or Succulents

• In a Low-Light Room: Chinese Evergreen, or Aglaonema

• In a Drafty Room: Christmas Cactus or Jade Plants

2. Too Much Granite

Granite is a popular option when choosing kitchen counters, but avoid going overboard by adding accents such as quartz or butcher block countertop for your kitchen island and workspace.

3. Industrial Everything

Industrial home decor has been popular for decades; Edison bulbs, exposed brick, rusted or brushed metal accents are a few examples of this decor design. However, there is such a thing as too much industrial. If you want to go for an industrial look inside of your home, add a couple of elements such as modern pendant lights or a pegboard backsplash.

4. All Grey Everything

Adding to the Industrial trend we’ve listed prior to this, all grey rooms can sometimes make a room feel dull and life-less in contrary to creating a calming and minimal environment. If it is too late to re-paint your walls or you absolutely adore your grey furniture, try adding in some vivid colored plants or wall decor that is an appropriate fit for the type room.

5. Vertical Blinds

Vertical blinds can be a pain to open, close, and can become tangled easily. So most home decor enthusiasts update to mini blinds, DIY window treatments, and lightweight curtains to preserve the abundant natural sunlight in their homes.

6. Indoor Wicker Furniture

Wicker furniture is typically a top choice for your balcony or porch, so keep the wicker outside. When used indoors, wicker is one of those home trends that can quickly make a home look dated.

7. Carriage hinges

Carriage Hinges are most popularly found on tilt-up retractable garage doors that usually do not open like shed doors. This trend could make your home garage feel more like a barn shed as opposed to a destination for your vehicle.

8. Tuscan-Inspired Kitchens

A popular kitchen design trend for just about two decades, but Tuscan kitchens are starting to lose their appeal. Instead of lots of stone and darker colors, today’s kitchens focus on brighter lighting and a crisp color palette for home trends.

9. Brass Hardware

Metals may be in when it comes to accessories, but avoid shiny brass as it can make a kitchen look dated. Instead, replace cabinet hardware with brushed nickel, glass or stainless steel.

10. Bold Appliances

Bold kitchen colors are on-trend, but avoid choosing bright colors for appliances. You wouldn’t put a ’70s avocado green or goldenrod refrigerator in your kitchen now, so just imagine how that bold red or seafoam green appliance will in a few years.

We hope this list is helpful to your home modernization, we anticipate the various point of views about trendy home decor. Please let us know what your thoughts are in the comment section below, or tag us in your post on any social platform!

more...

As the brisk winds of winter approach us, Advent Properties is here to keep you updated on how you can prepare to keep your home warm, cozy, clean and sturdy!

For your safety, and to avoid damage to your property inside and out; it is best to routinely clean your microwave and oven, range hood filters, unclog sink and drain holes, replace heater filter, and check smoke alarms and fire extinguishers on a monthly basis. more...

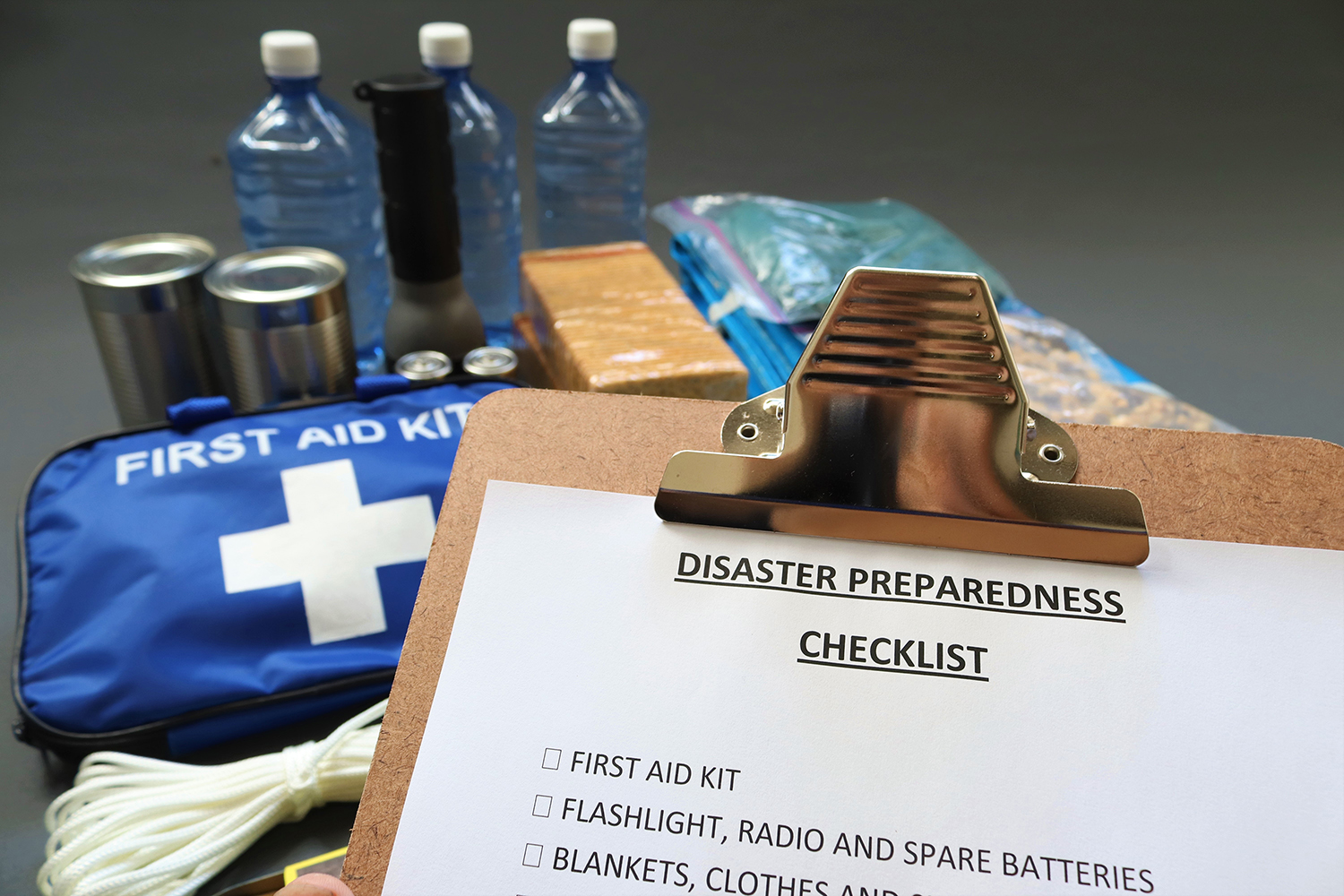

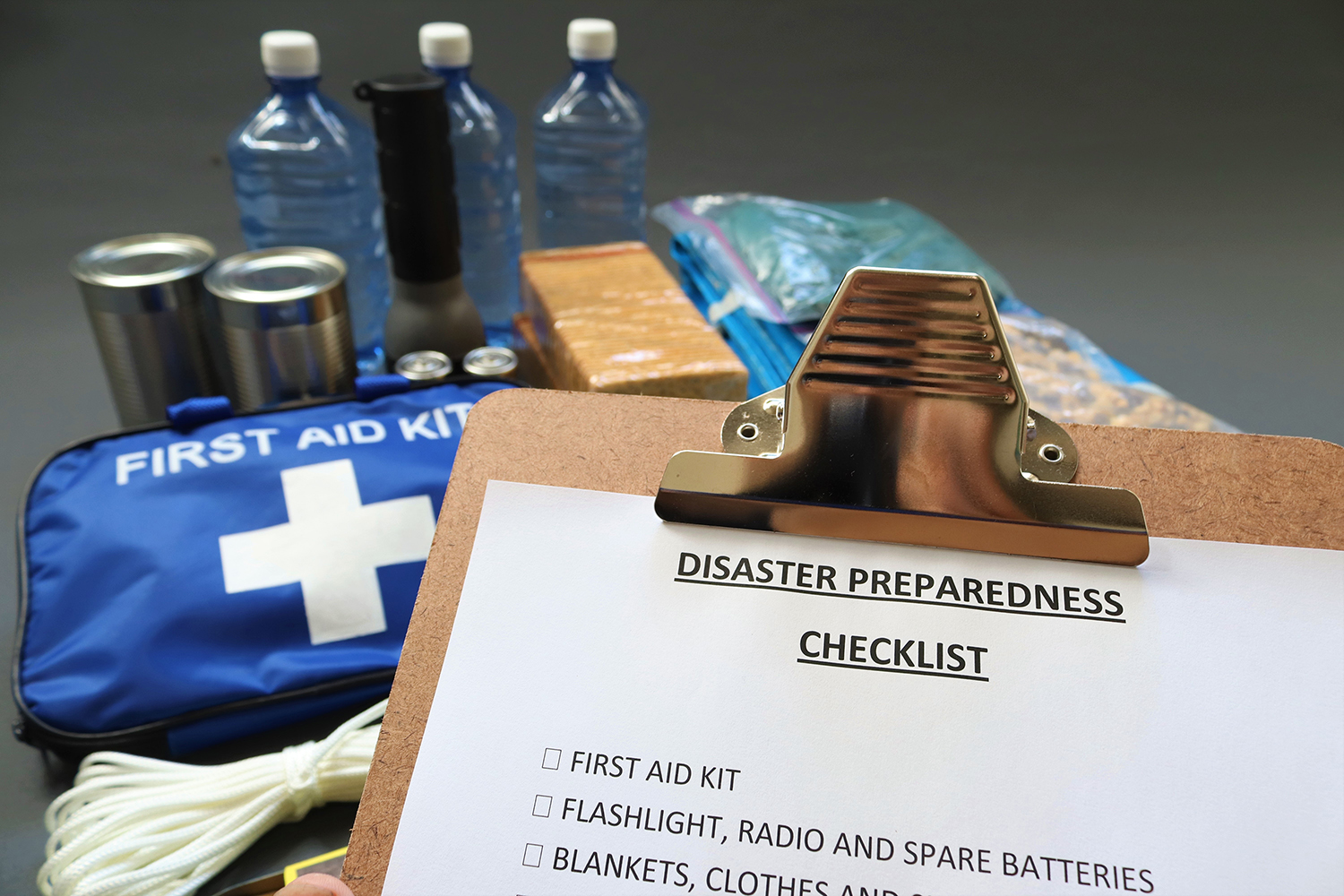

Today is the 30th anniversary of the Loma Prieta earthquake, the 6.9 tremors stuck October 17th, 1989 shortly before game 3 of the World Series concern with the safety between the Oakland Athletics and the San Francisco Giants. With concern for your safety and well-being, we will update you with quake-related coverage and how you can be best prepared for forthcoming devastating Earthquakes.

Are you ready for the next major Earthquake?—You should be! more...

.jpg)